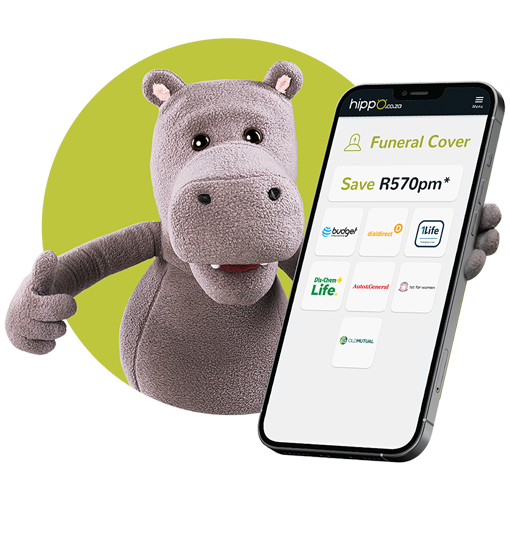

Find the Best Funeral Cover! Compare Quotes in Minutes.

Please start by telling us how much funeral cover you need, and our trusted providers will tailor quotes for you in minutes.

-

Compare funeral insurance from 7 top SA providers in just 2 minutes.

Compare funeral insurance from 7 top SA providers in just 2 minutes.

-

Get funeral cover from authorised and vetted FSPs you can trust.

Get funeral cover from authorised and vetted FSPs you can trust.

-

See exactly what you will pay and what cover you will get before you decide.

See exactly what you will pay and what cover you will get before you decide.

-

Free to use with no hidden fees or markups. You get the best price guaranteed.

Free to use with no hidden fees or markups. You get the best price guaranteed.

-

Your data is safe. We never share or sell your information.

Your data is safe. We never share or sell your information.

FAQ

What Is Funeral Cover?

Funeral cover or funeral insurance is a type of insurance which pays out a lump sum when you, the beneficiary, pass away. You can also purchase a family funeral plan, sometimes referred to as extended cover, which pays out a lump sum in the event of the death of your partner/spouse, your child/children, and/or any other family member that you have chosen to cover with the policy. The money paid out is intended to help with the cost of the funeral.

Why You Should Have Funeral Cover

There are few things in life as tragic and heartbreaking as an unexpected death in the family. This trauma is only compounded if, while trying to come to terms with their loss, the family has to deal with the cost of arranging a funeral to honour the memory of their loved one as well.

Did you know that South Africa has, on average, some of the highest funeral costs in the world? A funeral can be financially ruinous if you aren’t expecting it, or if your late loved one hasn’t made provision for it. Depending on your family tradition or custom, the costs could pile up into tens of thousands of rands, if you include the undertaker’s fee, buying the burial plot and more. This is a steep cost to bear out of pocket!

The Benefits of Funeral Cover

A funeral policy helps you cover these costs by giving you a lump sum payout when the named beneficiary of the policy dies. These payouts are typically faster than other types of insurance, like life insurance, which means funding the funeral is the one thing you don’t have to worry about at this time. Depending on the funeral cover policy, payouts can include airtime, flowers, catering and tent hire, among other necessities.

Life insurance is based on an individual’s profile and needs, which comes with complex underwriting requirements, making it comparatively more expensive. Funeral cover doesn’t have this problem. Thus funeral cover is cheaper and easier for you to get compared to life insurance. However, most funeral cover policies will have a waiting period for natural deaths of 6 to 12 months, so if you’d like a funeral cover with no waiting period, you need to specify this need.

Do you give or sell my details to any third parties?

No, we do not. Your details are held securely and we do not share or sell your details to any 3rd parties. As South Africa's go-to for free funeral insurance quotes, we pride ourselves in treating customers fairly (TCF) and protecting your data and the way we deal with you.

If I choose a quote, does that mean I'm making a commitment?

No, you're under no obligation at all. After choosing a brand's online quote, you will simply get an obligation-free call from a consultant from that company to find out more about their offer. They will also help to arrange your cover and requirements thereof over the phone if you do choose to continue with them.

What does a Funeral Plan cover?

A funeral plan pays out a lump sum when you pass away. You can also purchase a family funeral plan, sometimes referred to as extended cover, which pays out a lump sum in the event of the death of your partner/spouse, your child/children, and/or any other family member, you have chosen to cover with the policy.

A research paper titled “Paying the Piper: The High Cost of Funerals in South Africa” found that households spent on average the equivalent of a year's income on an adult's funeral, measured at median per capita African (Black) income during January 2003 to December 2005.

Considering the high cost of living over the last 10 years, are you adequately covered?

Expert Tools, Tips and Guides

Essential information, tools, and insights designed to assist you in navigating the complex world of funeral insurance.

Our Guides

-

Funeral Cover for Parents: Funeral cover for parents allows those taking care of their parents financially to add them to their existing or new funeral cover policy. When one or both of your parents pass away, a lump sum will be paid out.

-

Funeral Cover for Over 80's: Funeral cover for people over the age of 80 allows you to prepare financially for the costs involved in arranging a funeral if you have not done so yet, without a medical test.

-

Funeral Cover for Extended Family: This type of funeral cover plan covers the costs of an extended family member’s funeral in order to relieve your family of the financial burden. A lump sum will be paid out upon official proof of death.

Our Tips

-

Funeral Arrangements Checklist Are you arranging a funeral for a family member? Or would you like to know what to do in the event a family member passes away?

-

Funeral Cover With No Waiting Period: This type of Funeral Cover offers an option where there is no waiting period for a policy to be paid out to your beneficiaries in the event of accidental death.

-

Family Funeral Cover: Family funeral cover takes care of the burial expenses in the event that you, your spouse, children or parents pass away.

This is perfect and user friendly

I saw the advert on my phone confirming that if I need assistance when looking for insurance Hippo can assist. The advert also told me to press for urgent assistance. I did. I was assisted immediately.

I'm happy to choose hippo because it has options of all insurance companies

By advertising on social media all insurance companies. I have saved R400 from the insurance that I choose.

Amazing service rendered

Execellent service, timeous response, great communication and a good overall experience finding the ideal insurance for you.

Great Service

I was desperate for an insurance an affordable premium as Auto General had suddenly communicated that they would charge me R2400. Hippo provided affordable options and within 3 hours, I had new insurance cover at a good rate and the old insurance cancelled.

Customer Experience

The lady that helped she was the best and honest with everything we discussed about their insurance company. Thank you dear for the best customer service.

The ins ‘n outs of funeral insurance

Hippo’s top tips to getting more out.