Looking for balloon payment tips that work? Nobody wants that final payment to catch them off guard. The best way to prevent a balloon payment from becoming a financial burden is to plan ahead and manage your vehicle finance wisely. While a balloon payment can make your monthly instalments more affordable, you don’t want to be left scrambling when it’s time to settle the big one. Think about making sure you’ve got a solid plan in place.

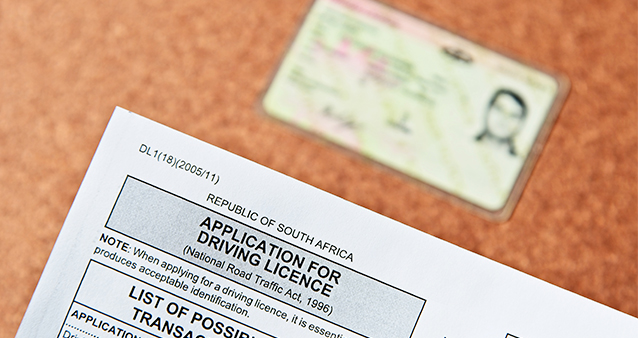

The time has come for you to renew your driver's licence. You're probably already dreading dealing with the admin, the queues snaking out the door, and the looks of exasperation on the faces of disgruntled government employees. Our quick driver’s licence renewal guide will help you get it done in no time.

Bakkies are more than just vehicles in South Africa; they're a cultural icon, embodying the rugged, industrious spirit of the nation. From urban centers to remote dorpies, this guide explores the ubiquitous presence of bakkies across the country, and why they hold such a special place in the heart of every South African.

Buying a home? The first step is knowing what you can afford. We reviewed South Africa’s top home loan affordability calculators, including tools from BetterBond, Ooba, Nedbank, FNB, and Standard Bank. Find out which calculator is the best fit for your home-buying journey and start budgeting smartly today!

The GWM P-Series is South Africa’s budget-friendly bakkie beast, offering premium features at a fraction of the cost. But why stop at savings on the purchase? With Hippo, you can save on car insurance and reinvest in upgrades, adventure gear, and accessories. Compare and start spending smartly today!

South Africans' love for bakkies runs deep, and 2024 sales prove their popularity isn’t fading despite rising costs. This article explores the best-selling bakkies, their ownership expenses, and insurance premiums. If you're in the market for a new pickup or just curious about costs, we’ve got you covered. Let’s dive into South Africa’s favorite bakkies!

All Risk Insurance protects your valuables when you take them outside your home, but does it cover everything? From exclusions to policy limits, understanding your coverage is crucial. Learn the five must-knows about All Risk Insurance, so you can safeguard your possessions the right way. Get smarter about insurance today!

Finding business funding doesn’t have to be stressful. Whether you need to sustain, grow, or launch your business, there are various options available in South Africa. From working capital loans to government schemes and crowdfunding, explore six funding solutions to help your business thrive. Compare business loan quotes today with Hippo!

Navigating adulthood means managing expenses for essentials like Medical Aid—a necessity that often feels like a burden until it’s needed. Hippo simplifies the process, saving you time and money by comparing top plans in minutes. Discover how to protect your health and wallet with ease. Adulting doesn’t have to be hard—Hippo is here to help!

The BMW 3-Series isn’t just a car—it’s a statement. From corporate lots to shisanyamas, it’s a chameleon of style and success. But owning one doesn’t have to break the bank. Discover how Hippo helps 3-Series drivers stay upwardly mobile by saving R455 per month* on car insurance, freeing up cash for modern-day must-haves.

As 2024 drew to a close, South African drivers stuck to their favorites, with the Toyota Corolla topping the charts yet again. But beyond the buzz, how do these best-sellers stack up on insurance, fuel costs, and monthly repayments? Dive into Hippo’s breakdown of December’s top cars to find the perfect fit for your lifestyle and budget.

Car insurance is often overlooked, but it is one of the most critical financial decisions a driver can make. This blog explores the risks of driving uninsured, the potential costs of accidents, and the peace of mind offered by affordable coverage options. Read on to learn how to protect your vehicle and your wallet!

While you may have some form of medical aid plan, depending on its structure, more often than not the scheme will not cover all the doctor and other specialist fees, or all procedures in hospital. Medical gap cover pays the difference between the medical aid rates and the higher actual cost charged.

Secondhand cars have definitely become the preferred option for South Africans hitting the road in the last few years. Don’t believe us? The data backs it up: in the first half of 2024, over twice as many people applied for used car loans compared to new car loans, underscoring how affordability drives consumer choice.

Looking to spice up your savings and lifestyle at the same time? In this month’s "Around the Spend" feature, we dive into the Kia Rio, a compact yet vibrant car with a Brazilian flair that’s made waves in South Africa. From saving on car insurance with Hippo to spending on everything from shades to swimwear, here’s how you can bring a bit of Rio’s zest into your everyday life.

The reality is, during your 20s, you slowly begin to build a collection of valuables. You may not even realise it, but that TV, the gaming console, the designer clothes, your personal laptop, the appliances in your kitchen—all of these items add up. Usually, in their 20s people accumulate a sizable number of assets.

Most new cars come with a motor warranty or service plan that helps you pay for a certain number of services or repairs for a set number of years or kilometres. However, if you have an older car this plan might have run out, meaning it’s up to you to foot these bills. OR, you can be a smart cookie and extend or take out another motor warranty or service plan. In this piece, we explained what these plans are and what to consider when getting one

Car dings, dents, and scratches are a frustrating part of vehicle ownership. From shopping trolleys to stone chips and mystery scratches, damages happen anytime. This guide helps identify different types of damage and offers advice on addressing them, whether through simple fixes or using scratch and dent insuranc.

In this edition of Hippo's Around the Spend, we take a fun look at the popular Hyundai i20 and explore other iconic "i" products you could buy with the money you save by using Hippo. From tech gadgets like Apple's iPhone and iMac, to everyday essentials like ID cards and I&J’s crispy fish, we dive into how much you can stretch that R390* monthly saving. Whether you're a young driver in Gauteng or simply curious about where your savings can take you, Hippo is here to help you compare and get the best deals, quickly and easily.

Laughter may be the best medicine, but when it comes to staying healthy, there’s no substitute for proper medical aid. Whether it’s a late-night trip to the ER or a routine check-up, knowing you have the right coverage offers peace of mind when you need it most. At Hippo, we’re here to simplify the process of finding a medical aid plan that fits your needs and budget, ensuring you can focus on what matters most—your health, without worrying about unexpected costs.

Nothing embodies South African manliness more than a bakkie. And the Hilux has long been the alpha male amongst sports-loving, vuvuzela-blasting, replica jersey-wearing, shisinyama-mastering, salad-dodging, carwash-jolling, beer-savouring, biltong-vreeting, nature-loving, tool-wielding, hard-working guys across our World Cup-winning Rainbow nation.

From Midrand to Mamelodi, Alex to Alberton, and Soweto to Spruitview, Gauteng gents between 28 and 35 are buying Polos. They’ve hustled, side hustled, studied, and secured jobs to get these iconic whips which are rightfully their pride and joy. They’ve grafted hard for these status symbols and the associated lifestyle of a Polo player.

Picture this: it’s life after lockdown and you are finally back on track with your budget. You’re relieved that you can afford to pick up those payments you decided to drop to spare your pocket. You can insure your car again… But then comes the shock: your premiums are suddenly far higher than what you were paying before the lockdown! What happened?

It might be the perfect time to review your Medical Aid policy and decide whether you’ll need to upgrade or downgrade your current plan. But, deciding on the right scheme or plan can be daunting, as you’re constantly bombarded with Medical Aid jargon. Luckily, this year you’ll be in the know. We’ve taken a closer look at some Medical Aid terms to help you understand what they mean, so you can make an informed decision.

Unveil the essential role of event liability insurance in safeguarding the success and financial stability of events. Whether orchestrating corporate functions or personal celebrations, this insurance provides peace of mind, bolsters credibility, making it an indispensable asset for discerning event planners seeking to ensure seamless and secure events.

The South African Council for Medical Schemes has just announced their suggested increase percentage margin (5% + utilisation) for the 2023/2024 medical aid scheme premium increases coming up. Let's find out what that means for you and if there's anything you can do to ease the impact of coming changes on your pocket.

Ah, the joys of car ownership: the wind in your hair, the open road, the gentle purr of the engine... until, of course, it all goes horribly wrong. A blinking light, a rattling sound that just won't go away and – bham! You're left with a hefty bill for repairs. And that, friends, is why you should always take out a Service Plan.

Is your car on the shopping list of South Africa's brazen car thieves? Compare the list of the most commonly stolen cars with the bestselling cars and you'll notice that this country's thieves seem to favour the same vehicles as most of the honest population. Let's look at the most frequently stolen or hijacked vehicles in SA and how these numbers might affect you as an owner.

Fibre internet is one of the latest and most advanced technologies in the field of telecommunications. It has revolutionised the way people access the internet, offering faster and more reliable connections. But what exactly is fibre internet, how does it work, and how is it different from other internet technologies? In this comprehensive article, we will answer all your questions related to fibre internet.

In the grand scheme of life, you don't have to worry about trying to decipher the difference between a medical aid and a hospital plan. We know it can feel like you are trying to understand why the chicken crossed the road - we all think we know, but do we really? That's where hippo.co.za comes in to save the day. Let's start with the basics.

Over the course of the past decade, Porsche has claimed the South African Car of the Year (Coty) title four times. 2020's winner was the Jaguar I-PACE, which costs about the same as a two-bedroom apartment in northern Joburg. Much like the glory days of Top Gear, you'd be forgiven for thinking that SA's Coty jurors had become... what's a nice way of saying this?... out of touch.

Thanks to home fibre connections and streaming services, we're all watching more television now than ever before. But how do you decide what to watch when the buffet table is creaking under the weight of so much good stuff? Sibongile Mafu lets us in on the TV guilty pleasures you need to stream right now.

More people than ever before were using fibre internet (otherwise known as fibre to the home, or FTTH) in their homes last year, as we've all had to adjust to working (and learning, and playing, and everything else) from home during the pandemic. With nationwide vaccine rollouts and herd immunity still a long way off, 2021 could be another year of working from home for many of us, and if you don't have a fibre connection yet, here's what you need to consider.

A seismic shift occurred in the South African car market at the end of 2020, as the Competition Commission released new regulations concerning vehicle servicing and maintenance. Informally known as the Right to Repair, it permits car owners to use any service provider and non-original parts to maintain their vehicles – without losing their manufacturer warranty.

COVID-19 treatment has been listed as a Prescribed Minimum Benefit (PMB) condition for medical scheme members by the Council for Medical Schemes (CMS). But what does this mean for you if you get 'long COVID', where you find yourself still experiencing symptoms months after you 'recover' from the initial period of sickness? Will your medical aid cover you?

You might already be a black belt when it comes to finding deals on things like smart phones and sneakers, but the amount of money you save by shopping smart shouldn’t stop there. Comparisons can help you find savings on bigger (unavoidable) expenses like car insurance, medical aid and even your home loan. Here’s how.

You may have heard the term debt management. Although it sounds like quite a mouthful, quite simply, debt management is a financial solution that can help manage your debt and ease financial strain. When it comes to debt management, there are two possible solutions to consider: debt counselling or a debt management or consolidation loan. But what is the difference between the two?

In this age of constant streaming for work, school and everything else, the days of being stuck with an unreliable internet connection should be behind us. Is your ISP doing right by you? Here's how comparing your current connection against what is available in the market, to see if you are actually getting what you signed up for, is a crucial part of ensuring you're getting the best service.

If you own a car, you may have noted that you didn’t get a reminder notice this year about renewing your licence. Have you checked on your windscreen for when your licence expires? Unfortunately, AARTO (Administrative Adjudication of Road Traffic Offences) is currently not sending these notices out, which may mean that many people have either forgotten to renew them or may not know how to do it…

The majority of people are on medical aid plans that cover in-hospital specialists' charges at 100% of the medical aid rate. In most instances, specialists charge more than 100% of the medical aid rates, potentially leaving you with a shortfall that you have to pay from your pocket. Depending on your medical aid plan, you may be covered for up to 300% of the scheme rate. This means that if the specialist's charges for in-hospital expenses are three times the general medical aid rate, your medical aid is sufficient. Medical gap cover is an insurance that will fill in the difference, should the specialist's charges be higher, rather than leaving you with what could be a large bill.

Buying a car is a big financial commitment and figuring out how you're going to pay for it beforehand is the best way to make sure you stay within your budget. If you want to buy a car and are looking for ways to save on the monthly repayments, you might be considering a balloon payment or residual value loan.

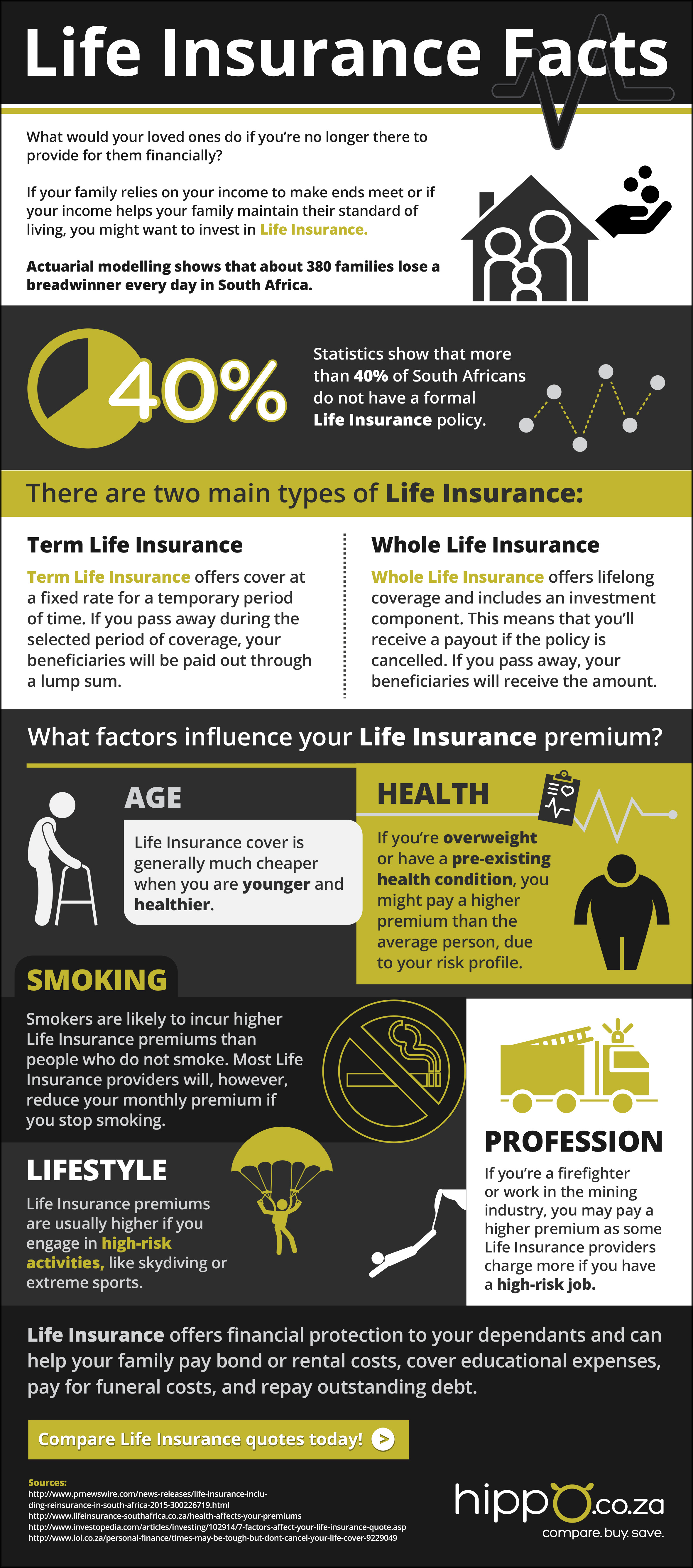

Understanding any contract that contains a lot of industry-specific jargon can be tricky for the everyday person. When it comes to a life insurance policy, understanding what you're covered for, what the specific benefits and payments are, and what the insurance company is and isn't committing to is very important.

Could the unexpected devastate your business? A power outage. A disgruntled or injured employee. A flash flood or hailstorm. Don't allow unexpected business interruptions caused by uncontrolled elements to knock your business into the red zone. Whatever emergencies or disasters could arise, preparing for them will help your company weather any storm.

Africa holds a fortune of resources, minerals, and wealth. Accessing this well of potential, however, has historically been a struggle for its inhabitants. That’s all changing though. Countries across Africa are working towards developing cities that can compete internationally in business, tourism, and resources.

In 2020, savvy consumers are looking to cut costs, scale down, and consume less. From clothes to cars, we're always on the hunt for the best value for money, and it should be no different with our medical aid. But making medical aid decisions is less fun and more cumbersome than choosing a SUV and takes a little discipline.

Thobeka “Thobi” Rose is a South African travel blogger and co-founder of Live Experiences, a blog Inspired by her own experiences of growing up in the city, but often travelling home to the rural regions of Kwa-Zulu Natal. Here she writes about her curiosity of how different groups of people interact in social spaces.

Tesla Motors unveiled their latest development in autonomous vehicle engineering at their Tesla Autonomous Day event on April 22 in Palo Alto, California. Tesla CEO and South African born billionaire Elon Musk took the opportunity to woo Tesla investors with the new FSD Computer Assembly hardware, the chip that Elon Musk says makes the Tesla the only financially viable option for consumers and ready to ship.

It’s hard to believe that 2009, the year that Avatar was the most popular movie and people danced to the Black Eyed Peas’ Boom Boom Pow, was 10 years ago. In that time, many fad diets have come, gone, and come again. Food science has changed vastly in the past few decades and has caused many heated debates on what’s healthy and unhealthy for the human body. Confusingly, different studies and research support both sides of food debates, so it’s hard to know what and how we should eat.

Back in the days, when there were no bank accounts, people used to save their money under the mattress. Cash was the only way to do business and if it was lost it or you were robbed, well, that was just the risk you took having to carry it everywhere. Hippo.co.za takes a look at the different kinds of payment methods available to find out why cash is still king for many.

Being pregnant is a wonderful time which shouldn’t be overshadowed by worrying about how you’re going to afford being a parent. While medical aid may go a long way to help manage the costs of pre- and post-natal care, there are other expenses that you can be prepared for to ensure your pregnancy is nine months of bliss.

Your lives are busy. With work, family, and friends, making quality time can be difficult for many couples. When your baby arrives, having time to connect with your partner alone will be nearly impossible for a while. On a babymoon, it’s just the two of you to help strengthen your relationship even more.

For a lot of people, staying debt-free is nearly impossible. At some point in your life, you may need credit to buy something, like a house or a car. Debt isn’t necessarily a bad thing when used to your advantage. After all, paying off debts on time is the best way to improve or maintain your credit record.

When you’re 18 years old, anything seems possible. Society considers you to be an adult and from here on out, your choices are your own. You get to decide who you want to be, what you want to do, and where you want to do it. If you or your child are thinking of taking a gap year, read these pros and cons to see if it’s the right decision for your family.

Any entrepreneur knows that keeping up with expenses when you’ve just started out can be overwhelming. Not only do you have all the expenses you did in your personal capacity, but on top of that you now have to cover business expenses like accounting software, business insurance, website hosting, and more.

The future is electric! We’ve been hearing that sentiment for quite some time. Despite the impracticalities around charging them, hefty price tags, and possibly even higher car insurance premiums, electric vehicles are finally coming into realisation. Companies are frantically playing catch-up with Tesla, but will they ever get there?

Your car is one of the most important items you can insure, so it’s a good idea to regularly check that you’re covered correctly. That’s what Car Insurance Day is for. Think about it – when last did you read through your policy to make sure it was up to date? If, say, your child has just started learning to drive, you’d likely need to tell your insurer to update the regular drivers on your policy; if you don’t, an accident claim could be rejected.

Travel visas can be an expensive hassle costing well over a thousand rand. Often, you’ll need to book an appointment at the nearest consulate or embassy, and before they will grant you a visa, you need to provide proof of holiday accommodation, return tickets, your financial standing, and the purpose of your visit.

Worldwide, one in every three women and one in every five men over 50 years old will fracture a bone due to osteoporosis, a progressive disease that causes bones to become weak and brittle. It occurs in one of two ways – either bones lose their density or the body doesn’t make enough bone. Either way, this forms large holes and spaces within bones and makes them easily breakable.

Toyota South Africa is firmly on top of the automotive pedestal. Outselling other vehicle manufacturers regularly, it’s considered to be a go-to brand for many drivers. Few brands have a grip on the automotive market quite like Toyota does in South Africa, and this has helped the company build an extensive customer base that’s loyal to them.

Soul food right on our doorstep! Hiking is a great way to get outdoors and experience some of the best of South African nature, all while re-energising the body. South Africans are spoilt for choice as far as hiking trails go, from short and comfy beginner trails to the more challenging routes for expert hikers. A great travel adventure has all the ingredients to excite every fibre in your being while invigorating the body, mind, and soul.

Weddings are a personal reflection of the special couple. A wedding day is a memorable celebration with family and friends as the happy couple sets off on a new life journey. When planning your wedding day, it really is about having your dreams come alive, but that can be pricey. Luckily, hippo.co.za has some awesome money saving tips to help you plan and pay for a dream wedding! Wouldn’t it be awesome to have some money left in the bank for the honeymoon?

While Car Insurance is not legally required for car owners in South Africa, many of us would agree it’s important cover to have. Fixing parts that have been damaged in an accident, whether your fault or not, can be costly and Car Insurance is a good financial fall back drivers can have to protect themselves when it might happen.

The year may not be over yet, but with summer around the corner there’s no time like the present to do a bit of spring cleaning. Spring cleaning need not only apply to your household though, your finances can be just as important to spruce up as your carpets. With threats of more petrol price hikes in the near future, a number of South Africans are tightening up their budgets and relooking at their finances. With this mind, here are a few tips to help you spring clean your finances.

While you may be very happy with your two-door set of wheels, if you’re planning on starting a family or are about to expand, it may be time to upgrade to a family car. Once the baby is here you’ll need a car that can take the child seat, pram and the toys. To help you make the right selection, here are some favourites for a family car in South Africa.

You’ve probably heard that most accidents happen around the corner from where a driver lives, however, several studies show you run the maximum risk of being involved in an accident if you drive on certain days and times. Researchers from North-West University (NWU) ran the stats on fatal car accidents to figure out the periods when drivers are most vulnerable to fatal car accidents on South African roads, and what type of car accidents are most common.

When thinking about car write-offs, an image that often comes to mind is a mangled wreck destined for a scrap yard. While extensive damages are often enough to warrant the car being written off as ‘beyond repair,’ in many instances the car is just not worth repairing even though it still looks to be in decent condition.

With smartphone adoption at an all time high, we have the world at our fingertips. A swipe of the screen and a touch of a button later, we’ve got all the information we need at any given time. While this has certainly made our lives easier in some regards, it has also led to an overload of information as we check our phones and tablets throughout the day, even when we’re out with friends.

We’re more than halfway through 2018 and while the summer holidays may still seem far away, some of us will be getting things in order for a trip overseas or even across the country. When you’re travelling, you’re sure to carry important information on you that must be kept safe, from your passport and air tickets, to driver’s licence and accommodation bookings. But many of us forget about the important information we keep and have access to on our devices.

Tax season started on 1 July, and while many of us don’t enjoy the process, it’s something we just have to get done. Whether you run a business and need to submit a tax return based on your business transactions, or need to submit your tax return purely on an individual basis, there are in fact some ways to make the most of it.

Poor road conditions can make driving a real challenge for motorists and can even result in vehicle damage or an accident. Potholes - a common sign that a road is deteriorating– are widespread throughout South Africa; according to the Johannesburg Roads Agency (JRA), 48% of the city’s roads have been identified as being in “poor” or “very poor” state while a poll by Wheels24 also ranks East London, Durban and Bloemfontein’s roads below top standard.

According to a report which first appeared on Times Live, an unknown but large number of South Africans were scammed out of millions of rands in an illicit plan involving the Bitcoin cryptocurrency. The fraud was on a large enough scale for the Hawks to get involved in May 2018 and their investigation continues.

If going to the movies is one of your favourite leisure activities, then you know how expensive it has become to go and see the latest blockbuster on the big screen. Considering the price of a cinema ticket nowadays, it’s easy to see why many adults prefer to watch new releases at home on their laptops or flat screens rather than opt for the movie-theatre experience.

Whether you’re buying your first car or your third, purchasing a car is a big deal. Considered to be the second biggest purchase you’ll make in your lifetime, after buying a house, purchasing your next car takes careful consideration. If you’re in the market for a new car, chances are the market has changed, prices are higher, and newer models are on offer every year. With so many options available, even experienced buyers look for guidance on what to look out for when buying a new car.

Teaching your children to be smart with money is a vital skill to impart on them. Being able to handle one’s money efficiently and effectively can help set you up for a lifetime of financial freedom. Starting your children’s financial education is then best started as soon as your children can count. The earlier you start, the more interested and confident they will be in managing their money correctly.

When you apply for a Personal Loan, credit card or retail account, some of the biggest factors that lenders take into consideration when calculating your creditworthiness are your previous payment behaviour and the number of accounts you have. What you may not be aware of is that not every financial activity will necessarily damage or improve your credit score.

According to a survey conducted by the Organ Donor Foundation (ODF) in 2017, 4 300 adults and children in South Africa are in need of a new organ, but only 361 transplants took place last year. Their studies further reveal that only around 0.2% of South Africans have registered as organ donors. South Africa is clearly in need of more donors, but many don’t understand the process, and possibly don’t know that one person can help up to 50 people through donating various organs and tissues.

So you’ve turned 18, you’ve got your learner’s licence, and you’ve decided it’s time to take the big test so that you can get yourself out onto the open road. While it’s an exciting time becoming a legal driver, the whole process can seem a little daunting. From booking your test to finding the right instructor, there are a number of steps you have to complete and forms you have to submit to get the process rolling, and it can all get quite confusing.

Working from home is just like running a business on a main street. You must conduct yourself in a professional manner when dealing with customers. You must ensure that your products and services are up to the standard your clientele expect. Adding to this, you face the same risks and liabilities as any other company.

South African motorists are locked in a seemingly constant battle with the high cost of fuel. The price of petrol has already climbed by 49 cents per litre in May and 82 cents per litre again in June. Forecasts now show we may be on track for another possible rise in July, while some even predict that it could cost R20 per litre to fill up our tanks by the end of 2019 if the rand continues its weak streak against the dollar.

We all want our beloved car to last as long as possible on the road. After all, some of us invested a small fortune in it and expect it to run well and look good whenever we take it for a drive. But, this is not always possible since your vehicle starts to depreciate the moment you drive it from the showroom floor.

One of the biggest concerns you may have in the aftermath of a car accident, is figuring how to seek compensation to fix or replace your car. A car accident can be a devastating and scary incident but it’s important to handle yourself correctly to achieve a positive outcome. Once you’ve assessed your own injuries, notified the police, and exchanged information with the other driver, you can get started determining the damages to your car and get the claims process started.

The purpose of a Funeral Cover policy is to cover the burial expenses such as buying a casket and paying the funeral director when you or a loved one passes away. It’s comforting to know that you’re financially protected against a death in the family and that your surviving loved ones can grieve without having to worry about how those funeral bills are going to be paid.

Driving in South Africa has its fair share of difficulties, from navigating potholes, to dodging taxis and getting delayed in roadworks. On top of this, there’s the chance of a flat tyre or even a fender bender. And while no one can predict these situations, you can deal with them far more effectively if you have the essential tools in your car. Whether you’re a regular road tripper or just rely on your car to get you to and from work everyday, having an emergency car kit makes a huge difference when you break down. Here are some essential items to put in your emergency car kit, to help you deal with car emergencies that you may find yourself in.

Hours after a parent, spouse or child passes away, you’re hit with the reality of making the funeral arrangements – a task you may not have hands-on experience with. You may have attended dozens of funerals before and already know the rituals that take place during the burial, but how do you pull it all together yourself considering all the challenges and decisions?

Many car owners choose to put their own stamp on their new set of wheels. Some may go to extreme lengths to make their car stand out on the road as seen in the popular television show Pimp My Ride, while others may make a few tweaks here and there. They may add modifications to enhance the performance of the car or simply to do cosmetic upgrades. Even used-car shoppers will likely come across a car with custom parts installed.

Legal procedures can cost large firms millions of dollars each year. Recently, two well-known brands were on the receiving end of major lawsuits launched by consumers. In 2017, Johnson & Johnson were ordered to compensate a Californian women who alleged she developed terminal ovarian cancer after using the company's talc-based products. Closer to home, a class-action lawsuit has been brought against Tiger Brands and its subsidiary Enterprise Foods for the at least 183 known deaths as a result of the listeria outbreak.

Starting up your own business can be a fun adventure. Being your own boss means that you can run your company how you’ve always wanted to, set your own hours, and even work from home. But while there are a host of things that will be new and exciting you also have to think about protecting your business’s finances and assets. Having Business Insurance is a vital part of running your business smoothly.

Travelling can be an expensive endeavour, and the temptation to dip into credit becomes greater if you realise your dream trip may be unaffordable. For those who love to travel, but do not have the upfront funds to make it happen immediately and, more importantly, don’t want to get themselves into debt, lay-buy travel is the answer you’ve been looking for.

The South African Reserve Bank (SARB) has been notified of over 5 000 alleged financial scams in South Africa over the past five years, and they advise South Africans to be extremely cautious when investing their hard-earned money. Financial scams are common in South Africa, and consumers are urged to be aware of schemes that promise high returns within a short space of time.

There are certain money mistakes that can cost you for the rest of your life, such as taking on too much debt or failing to save enough for your retirement. Ensure you remain financially stable by avoiding the following five money mistakes from a list compiled by three financial advisors who work with people and their money every single day

The average cost of education at a government school, from pre-primary to matric in South Africa can add up to around R1.5 million per child. This is a substantial amount of money parents would need to have access to during the course of their child’s educational career, yet according to Old Mutual’s Savings and Investment Monitor 2017, 56% of South Africans are currently not saving for their child's education.

Studying while working part-time is not an uncommon occurrence, studying while working full-time is a bit more of a challenge. Whether you’ve decided to upskill yourself and further your current career, change job paths completely, or begin your very first experience of tertiary education while getting work experience at the same time, it can be a daunting task to tackle.

Not only did living costs rise in 2017 but a lot of people battled with increasing debt, struggling to make it to the end of each month. If you’re among the many South Africans who found last year challenging when it came to finances, 2018 represents an opportunity for you to step into financial freedom.

The former Portuguese colony of Mozambique, is an East African country bordered by South Africa, Tanzania, Malawi, Zimbabwe, Zambia and Swaziland. Surrounded by the warm, clear waters of the Indian ocean, travellers can explore this paradise from its white palm-tree filled beaches, its cluster of islands just off its southern and northern coastlines, or from a nearby nature reserve filled with local wildlife.

In the aftermath of a car accident, one of the first things that Car Insurance companies do before processing a claim, is pinpointing who is partially or fully to blame. The company usually takes into account the police report describing circumstances that led to the accident and the actions of the drivers involved to conclude who is responsible for damages.

Organising a honeymoon can be the last thing on a couple’s mind while planning a wedding and looking forward to the big day, but it’s important to consider it before you tie the knot. According to The Wedding Expo, couples only allocate about 10% of their wedding day budget to their honeymoon, and as wedding plans come together and the budget grows almost daily, a honeymoon can become a daunting and expensive trip to plan.

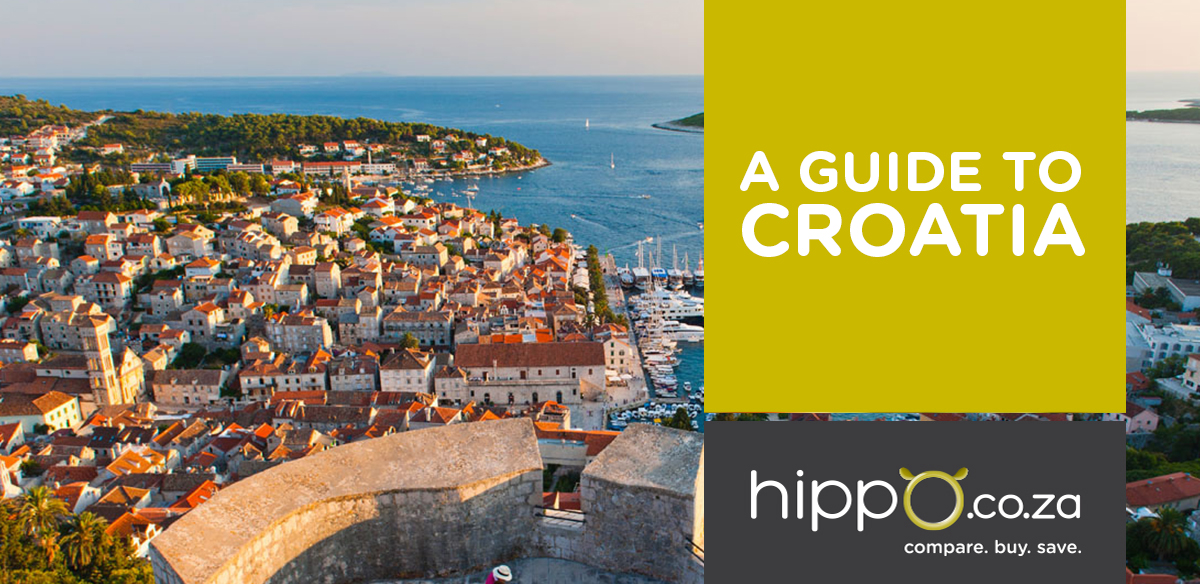

If you’re wanting to explore a slice of the Mediterranean, Croatia is the holiday destination for you. This Eastern European country is filled with a diverse and picturesque terrain, from clean white beaches and warm, strikingly blue waters, to lusciously green mountains and breathtaking lakes. With a rich history and architectural features reminiscent of the Roman era, this island-based Mediterranean destination offers South African travellers a Mediterranean experience second to none.

More than 50 million vehicles are recalled worldwide every year due to safety-related defects or problems. In South Africa, Ford made headlines this year after issuing a safety alert for its 1.6-litre engine Kuga models, some of which caught fire as a result of engine overheating conditions. Ford also withdrew its entry-level Figo and Ikon models mid-2017 because it has found these vehicles’ power steering high pressure hose poses a burn hazard.

Many people who enter the market for their first car can be overwhelmed by the countless financing options available. While almost every car buyer can apply for a vehicle loan, not everyone has the same credit history. In light of the ongoing economic troubles across the country, car buyers are finding it more difficult to secure funding for a brand-new car. Blacklisted or under-debt-review consumers are especially drawing the short straw when it comes to loan approval.

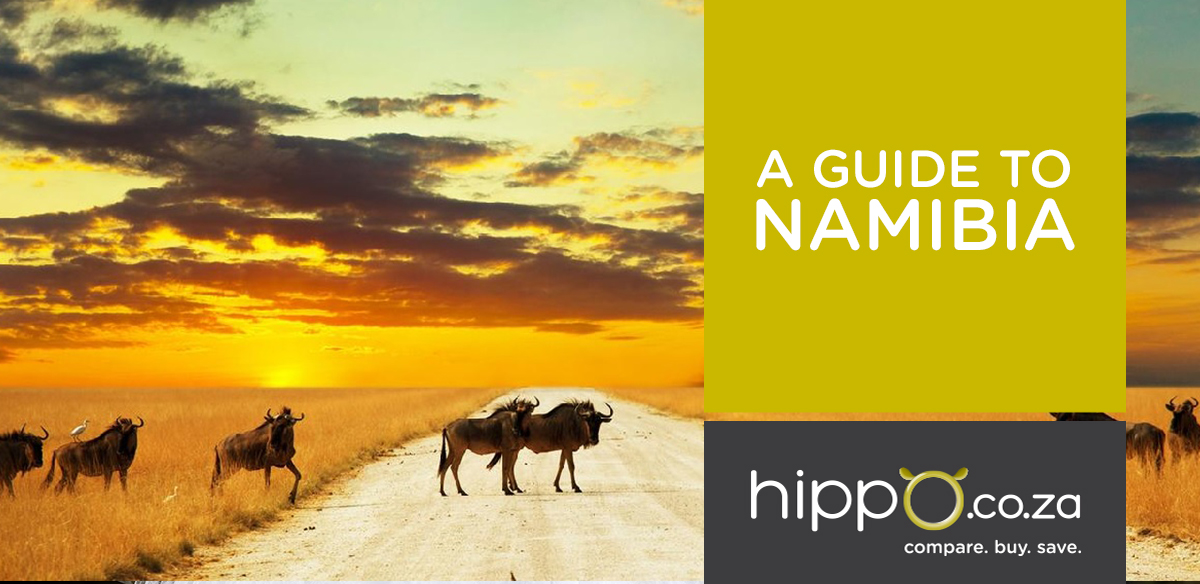

Home to the Namib, the oldest desert in the world, Namibia is a vast Southern African country that offers an abundance of outdoor adventures and tranquil escapes. As the 34th largest country in the world, Namibia also has one of the lowest populations in the world, at only 2.59 million as of 2017, emphasising its great distance between towns. With Namibia’s currency worth the same as South Africa’s, South Africans will find it a budget-friendly destination.

The East African country of Kenya is well-known for its vast wildlife, acacia trees located on enormous plains, and epic safaris encompassing the annual wildebeest migration. The country offers unrivaled views of the big five, Mount Kenya, neighbouring Tanzania’s famous Mt. Kilimanjaro, the Great Rift Valley and a sneak peak into the lives of the nomadic Maasai tribe in southern Kenya.

The top ranking universities in South Africa were revealed in a new university ranking focusing on academic quality which was recently released. The University Ranking by Academic Performance (URAP) highlights the performance of 16 South African universities among 2 500 higher education institutes (HEI) across the world.

A retirement annuity (RA) is a type of investment product where individuals contribute monthly cash payments to ensure a regular income after retirement. Unlike a Life Insurance policy, which provides financial stability for a family after the insured breadwinner dies, the savings from a retirement plan benefits the member of the annuity when they withdraw from an active working life one day.

If you have ever volunteered your time before, you might have noticed a mood lift, or bursts of satisfaction, happiness and elation. Volunteering is an unselfish act of giving of your free time and resources to those who need your help, and in due course you may experience the results of all your efforts, and even build a community of friends with whom you enjoy a shared interest and passion.

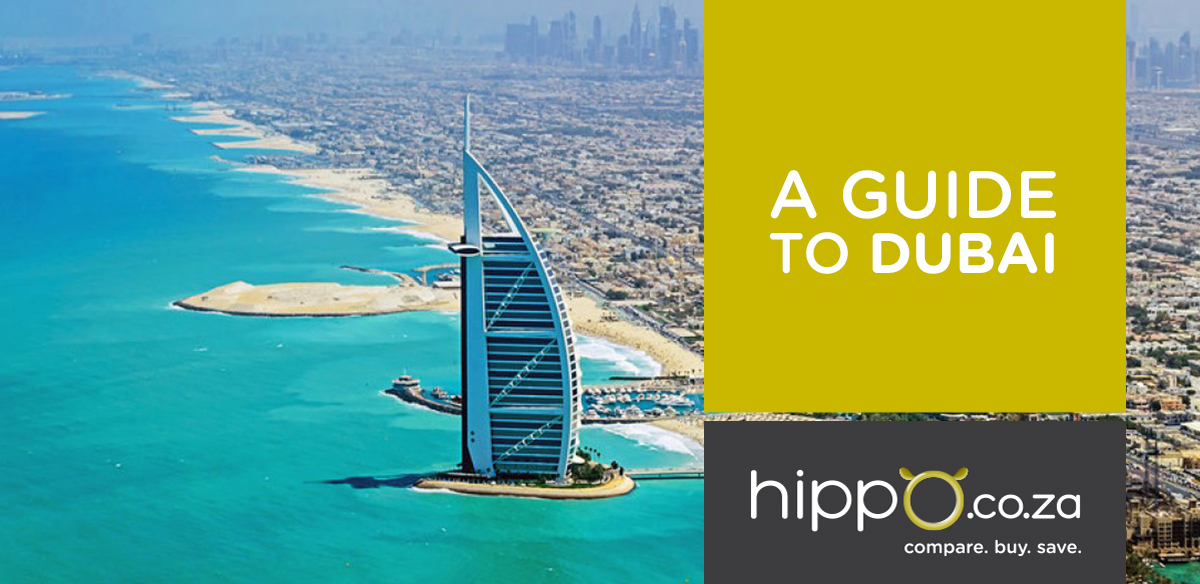

A tighter budget shouldn’t hamper South Africans’ desire to travel. We can still leave the African plains to follow those moments of wanderlust and experience the wonders of the world. The truth is, there are a number of countries that offer South Africans memorable and well-deserved holiday options without costing an arm and a leg. The first on our list of affordable countries for South Africans to travel to, is Dubai.

The South African Savings Institute (SASI) launched National Savings Month in Sandton in July 2017 as a reminder that we should all put some money away for a rainy day. Saving, however, means different things to different people. Some prefer to put their money in a savings account, others take out a Life Insurance policy, make off-shore investments, buy real estate or keep their money in stokvels.

With last year’s crime stats showing that break-ins at residential properties is the third most common crime in the country (at over a quarter of a million cases in 2016 according to a Business Tech report) do you know how likely it is that your home will be broken into? The architecture of your house can trigger burglary, and you probably aren’t even aware of it.

Tax return season for individuals officially opened on 1 July 2017. If you are a South African citizen, you may need to submit an income tax return to the South African Revenue Service (SARS) over the next couple of months (deadlines to be announced). The purpose of filing an income tax return is for SARS to determine how much money you owe the government or if you're due for a tax rebate.

The July holiday period will soon be upon us, and if you’re thinking of taking your friends or loved ones on a winter trip, now is the time to get it booked, if you haven’t done so already. There are plenty of destinations spread across South Africa to take your well-deserved break in, that offer activities to suit every want or need. If you’re dreaming of snuggling up next to a fireplace with a glass of red wine, looking forward to getting your fill of nature on a mountain hike, or keen to spot and photograph the wonderful varieties of flora and fauna the country has to offer, there is a destination for you.

Tax season is here, and maybe you’re one of the many people who don’t know where to start with their tax return. If you can’t rely on your employer or a tax practitioner to help you with your tax returns, there are some useful online tools that can assist you with your tax filing, so that you’re not left scratching your head.

May 2017 saw a fuel price hike of 49 cents per litre for 93 and 95 petrol, and a 30 cents per litre hike for diesel after a weakened Rand following President Jacob Zuma’s cabinet reshuffle. While analysts predict a possible decrease in fuel prices in June, the average South African motorist has to foot the bill until then.

BusinessTech reports that Nissan is collaborating with the uYilo e-Mobility programme to put on trial a system that enables electricity reserves in the LEAF's battery to be distributed to homes where it can be used for cooking and lighting. The experiment was implemented to help uYilo – a manufacturer of electric mobility technology – develop their charging technology in South Africa.

As government is busy making great effort to restore South Africa's investment grade rating, consumers must now deal with the consequences of Standard & Poor's junk rating. The economic outlook is even more uncertain as we await the announcement from Moody, which has placed South Africa under review for a downgrade and will only reveal its rating of South Africa's credit status around the July 3 deadline.

New vehicle sales in South Africa have increased by 3.7% from January 2016 to January 2017, a welcome improvement from the previous year of sales that saw an 11.4% drop from 2015 to 2016. With an increase in sales, and a seemingly spiked interest in new vehicles from the South African consumer, Hippo.co.za decided to take a look at the top 10 most searched for car brands in South Africa, according to the Google’s keyword planner search results.

This article presents several road scenarios that show the importance of mastering the art of defensive driving. Spotting and avoiding road hazards in time will not only ensure a safe driving environment for yourself and other road users but will also keep your driving record spotless (hint: Car Insurance companies take your driving record in consideration when calculating your premium and many will ask if you’ve had additional training).

Buying a car is usually one of the bigger financial ventures you'll take on in your lifetime. Whether you're in the market for a newly arrived model or intend to approach a used-car dealer, a key step in the car-buying process is figuring out how you're going to pay for it. With the year-on-year increase in car prices, many prospective buyers find that Vehicle Financing is the only way they'll be able to afford their dream car.

The current drought has forced the city of Cape Town to enforce increasingly severe limitations on water usage. The Cape Town city council said it is now up to every resident to use water wisely, and urged Capetonians to bring down their water consumption even further than the 800 million litres daily target to 700 million litres, or the city may be in an even more critical water crisis.

Motorcycle enthusiasts know that their lifestyle is more than wearing leathers, or going on unplanned adventures with fellow bikers. Sure, nothing beats the feeling of the wind in your face, the scenery, the smells and that sense of freedom, but imagine this sensory feast amplified by a rally or run where you can not only show off your bike but also your riding skills.

Often with a new year comes fresh starts and new resolutions, and if you’re feeling unhappy at work, the beginning of the year might be the best time to make a job, or even a career, change happen. Whether you’ve just finished matric, need a fresh routine or are unhappy with your current salary and have been relying on a Personal Loan to make ends meet, the job hunting process can be rather daunting if you don’t know where to start. With the help of a career expert, we lay out a few top tips to help you through the process, and increase your chances of getting a new job this year.

In South Africa, by last reports, approximately 11.9 million children (64% of all South African children) live in poverty. The closest possible consensus tells us that some 1.7 million children (9% of all South African children) still live in informal housing such as shacks in backyards or squatter settlements. Due to the number of independent adoption institutions in South Africa, and how loosely regulated they are, no one knows for certain how many adoptions of non-blood related children there are or have been in the country.

In September 2016, the Automobile Association (AA) published its first annual ‘Entry Level Vehicle Safety Report’, to identify and compare the safety features in 23 motor vehicles available on the South African market for under R150 000. Poor economic growth, coupled with the increasing price of new motor vehicles has put pressure on young South African drivers, who are looking for an affordable yet safe vehicle. Worryingly, those looking for a vehicle seem to be more preoccupied with the affordability of a vehicle and not its safety features.

There seems to be an app for everything these days, from fitness tracking, photography and deal finders, to translation and even travel. So if you plan to travel around the country in the near future you might be wondering which of the thousands of travel apps might be worth getting hold of to help you have the best experience. You want to see all the big sites, find the best accommodation and do it all within your budget. Luckily, exploring and dining in a new city has never been easier with the help of some locally built apps that we’ve listed.

A recent study performed by Pharma Dynamics, has revealed interesting results on what the most stressful jobs in South Africa are, and surprisingly, the common corporate-related jobs aren’t at the top of the list. Stress can be measured in different ways, and different jobs can surface different types of stress-related symptoms, but according to the 2 000 respondents who come from over 40 different professional backgrounds, which professionals are the most stressed out?

Most of us are generally aware of the strategically placed luxury items which regularly feature close to the checkout counter of a grocery store. These items will usually include what retail outlets sometimes refer to as “impulse buys” being chocolate, sweets and snacks. What many of us do not put much thought into is how much the remainder of the store’s layout can influence our shopping behaviour.

While conventional wisdom tells us to stay away from meals served in foam containers or paper wraps, not all unhealthy food is bad for one's health. Hippo.co.za reached out to two nutrition experts to find out which foods, snacks and beverages traditionally considered dietary no-no's, may actually have positive health outcomes when taken in very limited portions and cooked the right way.

The faster you can sell your home, the faster you can access the capital you’ve invested in it and move on with your life. The reality, though, is that many houses sit stagnant on the market for several months. This not only eats into profit but may prevent you from moving forward with your property investments. It also means that expenses, like your bond and Household Insurance, keep ticking over all the time while it’s on the market.

Every year, companies and researchers run surveys across a variety of disciplines. Most of these studies shed light on customer or civil behaviour, but some also serve as eye-openers that can help us make informed decisions about certain aspects of our lives. Hippo.co.za gathered five statistics from the last three years to illustrate the importance of Life Insurance and planning ahead.

While the rain is coming down at right angles in Cape Town, and Johannesburg locals are shivering in icy temperatures, Durbanites are still going on day trips to the beach. Such is the balmy winter weather of this central KwaZulu-Natal city, and that’s what makes it the perfect place to escape to when you just can’t take the cold anymore. So book your flights to Durban, organise a Car Rental for your arrival, and make sure you’re protected with affordable Travel Insurance so you can enjoy fun in the sun with peace of mind.

It’s an inevitable part of being a parent that at some point you’ll have a sick child on your hands. For more serious illnesses like chickenpox or ear infections, you’ll probably have to make a trip to the doctor, but for minor things like scrapes and cuts, sniffles and tummy bugs you can usually buy over-the-counter medicine to help relieve your little one’s discomfort.

It was a turbulent year for the South African economy. From power shortages, drought and the axing of the finance minister to being downgraded by ratings agencies to a notch above “junk”, the country took a serious financial hit. But, with the reinstatement of Finance Minister Pravin Gordhan and a steadying Rand offering some relief, all may not be lost. Even though economic growth is of concern, we also know that where there have been problems, there are lessons for us to learn as well.

In the past, holidays were all about working on your tan, lounging by the swimming pool and eating too many pastries at the restaurant’s buffet. But, with the growing worldwide trend of personal health and wellness on the rise, holidays have become about much more than that – they’ve become another chance to work on your long-term health, another health investment on top of your Medical Aid plan.

The recent interest rate hikes, food price increases and generally tough economic times in South Africa right now mean that you’re probably feeling a little stretched financially. Personal Loans can help bridge the gap by providing financing in the short-term, which you can pay off in smaller amounts later.

Many of us fear being diagnosed with common diseases such as cancer or diabetes, but for a small percentage of the population, visiting a doctor has yielded more terrifying results. More people than you might think, worldwide, suffer from strange and shocking illnesses, many of which you may never have heard of. In this article, you’ll learn more about these conditions, which continue to perplex the medical industry.

Great filmmakers move us because they splice together the joy and heartache of life. Nowhere is this emotional rollercoaster more apparent than in comic portrayals of funerals. As the playwright George Bernard Shaw so aptly put it: “Life does not cease to be funny when people die any more than it ceases to be serious when people laugh.”

Some people are simply far too driven to be slowed down by the march of years. Their work will never be done, and although they may stop to smell the roses it will be when their schedules permit. It’s this sense of ambition and drive which inspires us all and assists in bolstering our otherwise flagging economy.

According to an article on Fin24, only about 10% of South Africans have a will. This seems like risky behaviour when the cost of drafting a will is the same amount you might spend on a gift for someone or a night out on the town. But in fact, a proper will could be the most important gift you ever give your loved ones besides having things like Life Insurance and Funeral Cover policies in place, so that they’re looked after when you’re gone. A will is a way of protecting your legacy and ensuring that after you pass away, your belongings and money are distributed as you want them to be.

As human beings, we're always pursuing meaningful experiences that add value to our lives. For some people, living life to the fullest often means pushing the boundaries. We want to accomplish great things before we depart this earth. That’s why we sometimes deliberately challenge our senses – which serve to shield us from danger – by engaging in extreme activities. We broaden our horizons by travelling to every country in the world, even the ones that top the "Most Dangerous Countries" list.

With food prices expected to increase by 10% by the middle of this year, many South Africans will have to rely on a Personal Loan to make ends meet. But, even when money is tight and we've obtained some extra bucks to help us get through the month, we sometimes get tempted to spoil ourselves with luxury indulgences. There are many high-priced lifestyle options ordinary folk may desire such as a R2 000 pair of designer shoes or a meal worth R600 at an upscale restaurant. Then, there is a pair of headphones that is worth over R800 000.

Are you aware of what you're eating? Of course you are, otherwise you wouldn't have ordered your favourite burger from your local fast food outlet. But do you know what it consists of? It may just seem like a tasty compilation of a bun, beef patty, cheese and tomato, but there may be more to that burger than meets the eye.

As we head into autumn, Mother Nature will be treating us to a few more weeks of extra daylight, clear skies and warm temperatures. Why not take advantage of the glorious weather and have some fun in the sun with your loved ones. If you prefer to seek excitement away from home, Travel Insurance may be all you need to ensure that your family enjoys a worry-free trip.

Every car runs the risk of malfunctioning at the worst possible time, which is why it's best to have Car Insurance so that you can protect yourself in the event of a car accident that may result from mechanical failure. Fortunately, you don't always need to be a mechanic to know when something is wrong with your precious set of wheels. Most of these problems can actually be detected by just listening, feeling and being alert while driving.

In an era where tobacco is one of the biggest public health threats, many smokers have embraced electronic cigarettes as a less harmful alternative to tobacco products. Some of these battery-powered devices look like traditional cigarettes and cigars, and all of them produce flavoured steam that not only simulate tobacco smoke, but also deliver a smaller amount of toxin-containing nicotine.

Your car suddenly won’t start. You lose your job unexpectedly. Your child needs urgent medical treatment. We don’t like to think about these things, but the reality is that life is unpredictable and you won’t always have enough savings to cover these unexpected expenses. That’s where emergency funds such as a Personal Loan can come in handy: they give you access to cash quickly in times when you need it most.

Let’s face it – credit has a bad reputation. When most of us think of short-term loans and credit cards, we think of high interest rates, huge monthly repayments and being stuck in an endless cycle of debt. But the truth is, having a credit facility can actually be really useful in managing your finances – as long as you know which product best suits your circumstances, and how to manage any resulting debt properly.

You may think of debt collectors as heavyset men with crowbars but the reality is that there may come a time where you are required to collect debt too. Maybe you lent your sister some cash to cover the cost of a new set of brake pads for her car? Maybe a friend needed to buy an engagement ring and you loaned him the money so he could marry the girl of his dreams?

Money. We all need it. We all want more of it. But sometimes, it can be difficult to get your head around how investments work with all the complex financial terms and concepts. Luckily, the team at Hippo.co.za is here to help. We went out and interviewed some of the brightest minds in the industry to get explanations on some financial and economic terms you may not understand.

“Netflix is finally here”. You might have seen this statement or others like it on your social media pages last week. This after Netflix announced that its service is now available in 130 new countries around the world, including South Africa. And, while most South Africans are eager to start streaming and argue the pros and cons of Netflix vs. ShowMax, some might have a few questions as to how video streaming actually works. Luckily Hippo.co.za is here to help. We’ve consulted various sources to ensure that you don’t experience any technical difficulties while binge-watching your favourite TV shows or movies.

Buying a first car is a huge decision for both parents and the young adult who’ll actually be driving it. Motives can often differ however, with the driver typically being focused on aesthetics, trends and fuel costs. The parents, though wanting to take the above into account, may still be more concerned with safety features and mechanical soundness – and, of course, Car Insurance options.

The festive season is almost here, which for many of us means the chance to get away and refresh ourselves at the end of a long year. But, if you’re thinking of going overseas for the holidays, the South African Rand exchange rate is unfortunately about as weak as it’s ever been. With cost cutting on everyone’s mind, we’ve compiled a guide of overseas destinations that give you a few of the best value for your Rand options from a forex point of view.

As we run between cubicles and stare at LED monitors for hours on end, we often forget that South Africa is a land of adventure, filled with unforgettable journeys - but it's up to you to embark on them. The holiday season is fast approaching and with the weather warming up, it is a perfect time to experience some of the greatest treks in South Africa.

The most popular science-fiction and fantasy adventurers often lead relatively intense and extraordinary lives, which is why we find them so compelling. But, saving the world from the forces of darkness does not come without risk. Not only do their pursuits jeopardise our heroes' lives, it can also have an impact on the future of their dependants.

Over the years, many South Africans have asked this one simple question, “Where has my airtime gone?. In response, there have been many answers from providers, some have been useful while others have seemed too vague or shifted responsibility. In this article, we’ll look at the most likely causes of airtime loss and what you can do to manage your data effectively. We’ll also take a look at how you can protect your privacy and data. While our goal is to protect your data, remember to also protect your hardware with Cellphone Cover.

For some of us, owning a motorbike is more than just an affordable means to get to work. It invokes a feeling of identity and freedom. When on the road, every toss and lean fires up the senses; every bump and vibration contributes to an exhilarating adventure. If you consider riding as a hallowed experience, you will know there's nothing that fuels your passion like a motorbike rally or run. It's a chance to rub shoulders with like-minded people, and an occasion where individual riders and motorbike clubs truly become a community.

He asked you to marry him and you said yes. Congratulations! So far you both have experienced a few weeks of post-engagement bliss, but now it's time to give the wedding some serious thought. When you get the preparations underway, some items on your checklist will be fun to execute while others, such as dealing with the cost of the wedding, can be overwhelming.

We all have different needs when it comes to our health and Medical Aid scheme. While you may have been with your current Medical Aid provider for quite some time now, it might be a good idea to review your current plan and ask the right questions such as how its provisions suit your current state of health.

Insurance companies usually look at demographic factors such as age, gender and location as one way to measure the risk profile of Car Insurance policy holders. For example, vehicle accidents are considered to be more frequent amongst male drivers 25 years and younger, hence this group tends to pay a higher rate on their Car Insurance premium.

Since its inception in 2008, Airbnb has experienced mounting success among travellers looking for low cost accommodation options without having to compromise on comfort. With listings in more than 35 000 cities and 192 countries, Airbnb rivals the conventional hospitality business model by allowing guests to rent lodgings online and directly from private property owners.

You may not feel comfortable reflecting on the subject of death, but sadly there will come a time when funeral arrangements have to be made for you and your loved ones. And, even though you cannot elude death, you can ensure you are well prepared for this unfortunate event by taking out funeral cover.

Hippo Blog Categories